IMPORTANT ARPA Deadline - December 31, 2024

Wednesday, December 18, 2024

As a reminder, the December 31, 2024 deadline to obligate your American Rescue Plan Act (ARPA) State and Local Fiscal Recovery Funds (SLFRF) is fast approaching. Counties must ensure these funds are fully allocated and have contractual commitments in place before the end of this year.

To assist counties with meeting this requirement, NACo released a webinar providing detailed guidance on obligations, eligible uses, and reporting requirements.

Resources:

- NACo Webinar Recording: Click Here to Watch

- PowerPoint Presentation: Access the Presentation Here

- NACo's ARPA Resource Hub: Access Link Here

The NACo presentation highlights:

- What counts as an obligation: contracts, interagency agreements, subawards, and personnel costs incurred before December 31, 2024 (page 8 of slideshow).

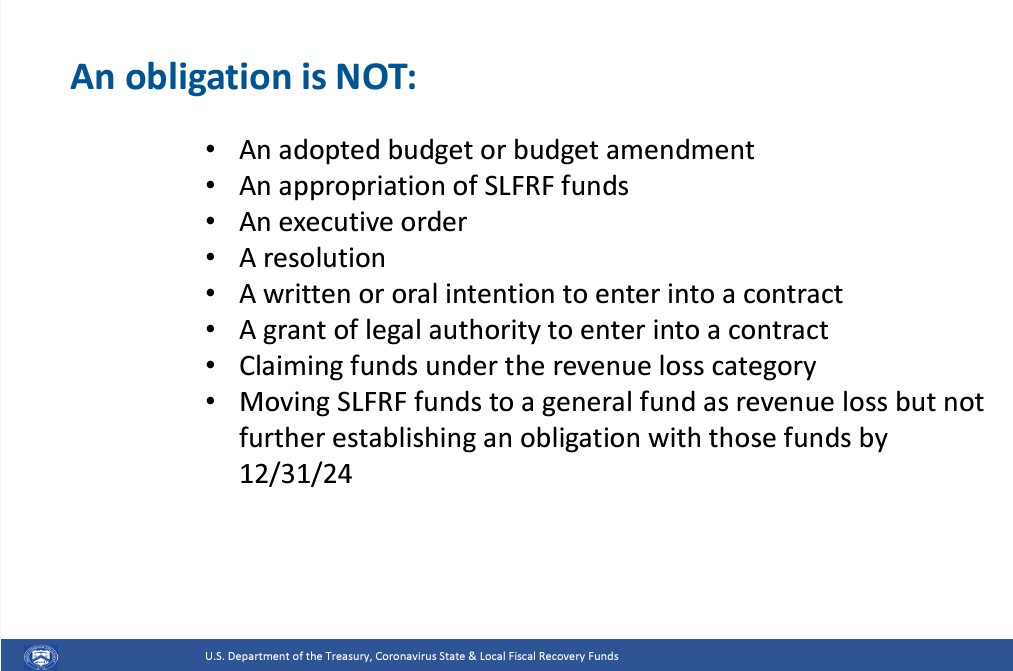

- What does not count: adopted budgets, appropriations, and verbal or written intentions to contract (page 9 of slideshow).

Key Deadlines:

-

December 31, 2024: Obligation deadline for all ARPA SLFRF funds

- December 31, 2026: Deadline to expend all obligated funds

Upcoming Reporting Deadlines to the U.S. Treasury:

- January 31, 2025 for quarterly reporters - (page 14 of slideshow):

- April 30, 2025 for annual reporters

Counties that fail to meet these deadlines will be required to return any uncommitted funds to the U.S. Treasury (page 17 of slideshow). It is critical to ensure all obligations are in place and reported correctly to avoid this outcome.

We encourage counties to take full advantage of NACo’s resources and guidance as you work to meet this milestone. If you have questions or need further assistance, please let us know.

Updated August 2023

Local Assistance and Tribal Consistency Funds (LATCF)

Reminder to Apply! During the NACo 2023 Annual Conference, the Treasury Department opened the portal for eligible counties to certify for their second tranche of Local Assistance and Tribal Consistency Funds (LATCF) payments. There are 673 remaining counties that have not yet certified for their second tranche . Click here to see if your county is on this list.

To receive the second tranche payment, eligible counties should take the following steps:

- Verify the county has an active SAM.gov registration by following the instructions below.

- Check if the county has an active SAM.gov registration (this is required to receive the second tranche) – Click here to check the status of an entity registration or Unique Entity ID assignment in SAM.gov and click here to update an existing entity registration in SAM.gov

- Enter the Treasury Submission Portal by signing in to ID.me. The designated submitter entering the portal through ID.me for the second tranche submission will be the same individual registered with ID.me who completed the first tranche submission. If your county needs to change the designated submitter, email COVIDReliefITSupport@treasury.gov with the subject “Entity Name - Update to Designated Individuals.”

- Complete the LATCF second tranche submission for your government by following the step-by-step submission guide here: LATCF Second Tranche Submission Portal Instructions.

- Confirm your second tranche submission has a status of “Submitted.”

Click here to see if your county is on this list.

Click here for LATCF Guidance

Updated April, 2023

|

|

|

|

Updated September 2022

RECIPIENT COMPLIANCE AND REPORTING GUIDANCE

Treasury released the updated Compliance and Reporting Guidance for the SLFRF Program (last updated September 20, 2022). The guidance provides additional detail and clarification for each recipient’s compliance and reporting responsibilities, and should be read in concert with the Award Terms and Conditions, the authorizing statute, the final rule, and other regulatory and statutory requirements.

Treasury is now accepting the Project and Expenditure Reports for SLFRF recipients through Treasury’s Portal.

Treasury has provided a list for Recipients to identify their Reporting Tiers here.

Updated 7/12/2022

Please view update from NACo regarding upcoming expenditure report deadline.

Following is an update ahead of the third quarterly Project and Expenditure (P&E) Report, which is due July 31, 2022.

Treasury released updated compliance and reporting guidance for counties ahead of the deadline that includes additional information that will be required as part of the reporting process and other clarifying items. Included below, you can find a comprehensive overview of updated compliance and reporting requirements, helpful information on specific sections of the reporting portal and an explanation of the difference between a subrecipient and beneficiary, and how counties can ensure they are complying with reporting requirements for these entities.

As a reminder, counties that are required to submit reports to Treasury by July 31, 2022, are those with populations above 250,000 residents and/or received $10 million or more in total ARPA Recovery Funds.

P&E Report Updates & Other Helpful Information

- Revenue replacement: Counties had the option to make a one-time election to either calculate revenue loss according to Treasury’s formula outlined in the Final Rule OR elect a “Standard Allowance” of up to $10 million, not to exceed the award allocation. Treasury has decided to keep this portion of the reporting portal open for recipients in the upcoming P&E reporting cycle, which will allow counties to update their prior revenue loss election.

- Once update, the prior revenue loss election will be replaced. Treasury expects to keep this portion of the reporting portal open through the April 2023 reporting period in order to provide an opportunity for annual reporters to take advantage of this flexibility.

- Interested/principal received from loans: Any interest received on loans made with Recovery Funds should be tracked as program income in the P&E Report.

- If a county uses revenue loss funds to fund a loan, repayments to loans are not subject to program income rules.

- DUNS and UEI Numbers: As of April 2022, the federal government switched service providers and stopped using the DUNS number and began using the Unique Entity ID (UEI) – All counties are required to switch from a DUNS number to a UEI moving forward.

- If your SAM.gov registration/DUNS number expired prior to April 2022, the county will be required to obtain a UEI before receiving its second tranche payment.

- Population threshold: A county’s population threshold is determined by Treasury at the award date and will NOT change during the reporting period. You can find your county’s reporting tier here.

- Edit and/or update previous report submissions: Counties can reopen and provide edits to submitted P&E Reports any time before the reporting deadline and will be required to re-certify the report to reflect any edits. After the reporting deadline, counties will be able to reflect changes in the next P&E Report.

- Additional programmatic data for capital expenditures: When using Recovery Funds for capital expenditures projects, counties need to report the type of expenditure based on a list of enumerated uses. Examples of enumerated uses are COVID-19 vaccination sites, job and workforce training centers, and public health data systems. A full list of enumerated uses is available on pages 27 to 28 of the updated guidance.

- Written justification for capital expenditures: Counties are required to provide a written justification for capital projects of any category that cost at least $10 million and for projects in the “other” (i.e., project not explicitly enumerated by Treasury) category that cost at least $1 million. Previously, counties needed to create a written justification for these projects but were not required to submit them as part of regular reporting.

- Description of labor requirements for capital expenditures: Counties are required to provide additional labor reporting. For projects that cost at least $10 million, counties will need to report on the strength of the project’s labor standards, including information on the presence of a project labor agreement, community benefits agreement, prevailing wage requirement, or local hiring. This new required information is outlined under Infrastructure Project on pages 30-31 of the updated guidance.

- Project information for broadband projects: The updated guidance requires counties to provide detailed project information for broadband infrastructure investments. Counties need to report what kind of technology is involved in the project (i.e., fiber optic cables, coaxial cables, etc.), the total miles of fiber deployed over the project, and the total number of funded locations served broken out by both speed of connection and type of location (i.e., residential, business, or community). This new required information is outlined under Broadband Projects on pages 32-33 of the updated guidance.

- Moving of Recovery Plan Performance Report data into P&E Report: Under the updated guidance, some of the data that was previously only required for the Recovery Plan Performance Report (Recovery Plan) is now required for large counties (i.e., populations above 250,000 and/or above $10 million in awards) on their quarterly P&E Report. For example, large counties investing in housing security programs must now report the number of households receiving eviction prevention services. A full list of changes to programmatic data requirements for large counties is available on page 33 of the compliance and reporting guidance.

- Updated template for Recovery Plan: The updated guidance also provides a template for the Recovery Plan due for large counties on July 31, 2022, reflecting the expenditure categories and other changes made by the Final Rule.

Overview of Subrecipients vs. Beneficiaries – Definitions and Reporting Requirements

The distinction between a subrecipient and beneficiary is contingent upon the rationale for why a recipient is providing funds to the individual or entity.

Definition

- Subrecipient: An entity that receives a subaward to carry out a project funded by Recovery Funds on behalf of the recipient (i.e. county).

- If a county is providing funds to the individual or entity for the purpose of carrying out an SLFRF-funded program or project on behalf of the county, the individual or entity is acting as a subrecipient.

- Beneficiary: If a county is providing funds to the individual or entity for the purpose of directly benefitting the individual or entity as a result of experiencing a public health impact or negative economic impact of the pandemic, the individual or entity is acting as a beneficiary.

- Individuals or entities that experienced the negative economic impact and are the recipients of a project funded by Recovery Funds. In other words, the households, small businesses, nonprofits, or impacted industries that experienced the negative economic impact.

Reporting requirements

- Subrecipients: All subrecipients are required to comply with all requirements of recipients such as treatment of eligible uses of funds, procurement and reporting requirements.

- Subrecipients are required to have an active SAM.gov registration and UEI number OR Taxpayer Identification Number (TIN), if unable to obtain a UEI

- Beneficiary: A beneficiary are not subject to subrecipient monitoring and reporting requirements.

- Beneficiaries are NOT required to register in SAM.gov and are not required to provide a UEI

Update 6/2/2022

Notice Regarding Second Round of ARPA Funds Distribution

The National Association of County Officials (NACo) is reporting that counties should be receiving or have already received their second round of American Rescue Plan Act Funding (ARPA). SAM accounts have to be renewed every 12 months. If your SAM account is not active, you will not be able to obtain your second-round payment. NACo also reported that there was a two-week lag time regarding the distribution. Please request that your assigned county staff person that is setup in the treasury portal check if your county has an active SAM.gov account and if you have received your second-round payment.

An entity that does not have an active SAM registration should visit SAM.gov to begin the entity registration or renewal process. Please note that completing a new SAM.gov registration can take up to three weeks.

Message from SAM.gov Website:

The unique entity identifier used in SAM.gov has changed.

On April 4, 2022, the unique entity identifier used across the federal government changed from the DUNS Number to the Unique Entity ID (generated by SAM.gov).

- The Unique Entity ID is a 12-character alphanumeric ID assigned to an entity by SAM.gov.

- As part of this transition, the DUNS Number has been removed from SAM.gov.

- Entity registration, searching, and data entry in SAM.gov now require use of the new Unique Entity ID.

- Existing registered entities can find their Unique Entity ID by following the steps here.

- New entities can get their Unique Entity ID at SAM.gov and, if required, complete an entity registration.

I manage an entity. What do I need to do?

For more information about this transition, visit SAM.gov or the Federal Service Desk, FSD.gov. You can search for help at FSD any time or request help from an FSD agent Monday–Friday 8 a.m. to 8 p.m. ET.

From US Treasury Website:

RECIPIENT COMPLIANCE AND REPORTING GUIDANCE

On February, 28, 2022, Treasury released the updated Compliance and Reporting Guidance for the SLFRF Program. The guidance provides additional detail and clarification for each recipient’s compliance and reporting responsibilities, and should be read in concert with the Award Terms and Conditions, the authorizing statute, the final rule, and other regulatory and statutory requirements.

Treasury is now accepting the Project and Expenditure Reports for certain recipients (only in Reporting Tiers 1, 2 and 3) through Treasury’s Portal.

Treasury has provided a list for Recipients to identify their Reporting Tiers here.

User Guides

Recipients should refer to the following user guides for step-by-step guidance for submitting the required SLFRF reports using Treasury’s Portal:

- Project and Expenditure Report

- Interim Report and Recovery Plan (in the event they are not yet submitted)

For States, territories, and metropolitan cities and counties with greater than 250,000 residents

- Recovery Plan Template - Required to be published annually on the recipient’s website and provided to Treasury. The Recovery Plan Performance Report will contain detailed project performance data, including information on efforts to improve equity and engage communities. This is a recommended template but recipients may modify this template as appropriate for their jurisdiction as long as it includes the required reporting elements.

For States and territories

- Non-entitlement Units of Government (NEU) and Units of general local government within counties that are not units of general local government (Non-UGLG) Distribution Templates User Guide - provides instructions and additional details to assist Recipients in completing the NEU and Non-UGLG reporting template.

For Non-entitlement units of local government (NEU)

- NEU and Non-UGLG Agreements and Supporting Documents User Guide – provides instructions to NEUs and Non-UGLG on setting accounts, assigning reporting roles, and providing required documentation to Treasury.

ACCESSING TREASURY'S PORTAL

The portal for the April 30 deadline will open early April.

Treasury Portal Instructions - Login.gov

Treasury Portal Instructions - ID.me

GUIDING PRINCIPLES

The SLFRF Reporting Guidance addresses priority areas for the SLFRF reporting process, specifically that it is:

- Accountable: The SLFRF requires program and performance reporting to build public awareness, increase accountability, and monitor compliance of eligible uses. Recipients are required to account for every dollar spent and provide detailed information on how funds are used.

- Transparent: Large recipients will publish a detailed Recovery Plan each year so the public is aware of how funds are being used and outcomes being achieved; Treasury will provide comprehensive public transparency reports each quarter across all recipients.

- User friendly: SLFRF reporting has improvements requested by recipients of CARES Act funding, including deadlines 30 days after the close of the reporting period (versus 10 days in CARES), streamlined requirements for smaller funding recipients, and increased availability of bulk upload capabilities.

- Focused on Recovery: The SLFRF reporting guidance addresses priority areas for a strong economic recovery, including provisions that prioritize equity, focus on economically distressed areas, support community empowerment, encourage strong labor practices, and spotlight evidence-based interventions.

UPDATED: January 28, 2022

From NACO's Website:

|

UPDATED: October 22, 2021

Join NACo for National Membership Calls on ARPA Recovery Fund Legislation:

On October 19, the U.S. Senate passed the bipartisan State, Local, Tribal, and Territorial Fiscal Recovery, Infrastructure, and Disaster Relief Flexibility Act (S. 3011), which would provide additional flexibility for the $350 billion Coronavirus State and Local Fiscal Recovery Fund (Recovery Fund) authorized under the American Rescue Plan Act (ARPA).

The legislation, which now heads to the U.S. House, would allow counties to allocate up to $10 million of Recovery Funds for government services or $10 million (or 30 percent) for highway and transit projects, and to address natural disasters.

If enacted, the bill would allow counties nationwide to use a total of over $27 billion for new transportation and infrastructure projects and over $17 billion for government services. Today, NACo sent a letter to U.S. House leadership urging swift passage of S. 3011.

Please join the National Association of Counties (NACo) today Monday, October 25 at 2 p.m. Central Time to learn more about the bill and how counties can support its final passage. Join us again on Tuesday, October 26 at 1 p.m. Central Time for the latest updates on eligible uses, reporting requirements and next steps for the release of the Final Rule for the Recovery Fund.

Click HERE to register for NACo Call on Monday, October 25 at 2:00 pm

Click HERE to register for NACo Call on Tuesday, October 26 at 1:00 PM

On September 30, the U.S. Treasury Department released a notice of a revised timeline for counties to submit Project and Expenditure Reports for the Coronavirus State and Local Fiscal Recovery Fund (Recovery Fund), which were originally due on October 31, 2021. Treasury states that, due to the comments and feedback gathered during the Interim Report and Recovery Plan Performance Report process, the department is revising the deadline for the submission of the first Project and Expenditure Report. Project and Expenditure Reports will now be due January 31, 2022 and will cover the period between award date and December 31, 2021.

Further instructions will be provided at a later date, including updates to existing guidance and a user guide to assist recipients in gathering and submitting information through Treasury’s Portal.

UPDATED: September 1, 2021

Update from US Treasury - September 1, 2021:

The U.S. Treasury understands that some recipients have had technical problems that have made it difficult for them to submit their interim reports on time. Treasury continues to assist individual recipients and hopes to resolve remaining technical issues as soon as possible. Those recipients who made a reasonable effort to file before the deadline will not be counted as late if they experienced technical issues in the reporting system that prevented them from filing on time.

For questions and technical issues with the U.S. Treasury reporting portal, please email COVIDReliefITSupport@treasury.gov

Click HERE to download notice.

UPDATED: AUGUST 31, 2021 From NACo

|

U.S. TREASURY ARP RECOVERY FUND REPORTS DUE TODAY |

|||

|

UPDATE FOR COUNTIES IMPACTED BY HURRICAN IDA & |

|||

|

TODAY, AUGUST 31 is the deadline for counties to submit the Interim Report and Recovery Plan Performance Report for the U.S. Treasury Department’s American Rescue Plan (ARP) Fiscal Recovery Fund.

As a reminder, only counties that received Recovery Funds prior to July 15, 2021 are required to sumbit Recovery Fund reports to the U.S. Treasury by today, August 31. If your county received Recovery Funds after July 15, 2021, you must submit your reports within 60 days of receiving funding. |

|||

|

|||

|

|||

|

|||

|

|||

|

660 North Capitol Street, NW, Suite 400 |

|||

|

Sign up to stay up-to-date on topics affecting America’s counties! |

UPDATE: AUGUST 25, 2021

Please click HERE to view notice on follow-up MAS Zoom Call August 27, 2021 at 2:00 pm regarding the Interim Report due August 31,2021. Zoom Notice Reminder

Click HERE for link to Treasury's webinar presentation on submitting the first Interim Report.

UPDATE: August 13, 2021

Please see below for county compliance and reporting requirements and deadlines for the Treasury ARP Fiscal Recovery Fund. Treasury also released a user guide for the ARP reporting portal, which includes step-by-step guidance for submitting the required Recovery Fund reports using Treasury’s portal.

Click HERE for link to submission portal

Click HERE for Treasury step-by-step guidance for submitting reports using Treasury's portal.

- Interim Report: Due by August 31, 2021, the Interim Report requires all counties to report programmatic data for spending between March 3 and July 31, 2021 (ONE TIME REPORT).

- A county must submit an Interim Report even if it hasn’t obligated or spent any Recovery Funds. The county should submit a report showing no ($0) obligations or expenditures have yet been incurred.

- If the county received Recovery Funds AFTER July 15, 2021, the county must submit an Interim Report within 60-days of receiving funding.

- Project and Expenditure Report: These reports are also required for all counties (with two tiers, see below) and require project and expenditure data for awards and sub-awards, demographic information for each project, and other programmatic data

- Initial Project and Expenditure Report is due October 31, 2021

- For counties with awards above $5 million, project and expenditure reports are due quarterly

- For counties with awards under $5 million, project and expenditure reports are due annually

- Initial Project and Expenditure Report is due October 31, 2021

- Recovery Plan Performance Report: Only required for counties with populations over 250,000 residents. The template for the Recovery Plan Performance Report (I.e. strategic plan) can be found here.

- Required to be published annually on the county website and provided to U.S. Treasury

- Contain detailed project performance data, including information on efforts to improve equity and engage communities

- Recovery Plan Performance Report is due August 31, 2021, followed by annual submission

Click HERE to download this notice

UPDATE: July 21,2021

Click HERE for MOU

Click HERE for MOU Notice

UPDATE: June 21, 2021

Please click HERE to view a video from NACo that summarizes the process for receiving State and Local COVID-19 Fiscal Recovery Funds and to view key reporting dates.

Click HERE to view a revenue loss calculator provided by NACo.You will find an excel sheet for download where you will input your data.

August 31, 2021: Interim Report is due. Counties must keep track of expenditures and report expenditures by category at the summary level. The interim report should cover spending from the date the counties received funds until July 31,2021.

October 31, 2021: Quarterly project and expenditure reports are due. Counties are required to submit quarterly project and expenditure reports, which shall include financial data, information on contracts and subawards over $50,000 and other information regarding the utilization of the funds. The first report will cover spending from the date counties received Recovery Funds to September 30,2021.

August 31, 2021: Recovery Plan Performance Reports are due for counties with a population of more than 250,000. The report should cover spending from the date the counties received funds until July 31,2021. Counties with a population of more than 250,000 must submit an annual recovery plan performance report which shall include description of projects funded and information on performance indicators and objectives of each award. The report should cover activity from date of receiving funds until July 31,2021.

Click HERE to print June 22, 2021 update.

UPDATE: June 8, 2021

Please click HERE for an updated FAQ Document from U.S. Treasury released on June 8 that provides clarification on eligible expenses and reporting requirements for the Coronavirus State and Local Fiscal Recovery Fund (Recovery Fund).

LINK: updated FAQ document

Click HERE for article released by NACo regarding updated FAQ document

UPDATE: June 3,2021

Open the following link to view the most update version of U.S. Treasury’s Frequently Asked Questions (FAQs) as of May 27, 2021, regarding the Coronavirus State and Local Fiscal Recovery Funds.

https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf

UPDATE 5/24/2021:

Click HERE for NACo Analysis of Fiscal Recovery Fund Guidance. The new report provides a comprehensive review of the Interim Final Rule, including an eligible use checklist for each section of the rule.

NACo is partnering with the U.S. Treasury on a national membership call on Tuesday, May 25 at 12:00 p.m. For more details, visit:

NACo URL: https://www.naco.org/events/naco-national-membership-call-26

If you have any questions regarding how to register, please email Alana Hurley ahurley@naco.org

Please click HERE for additional information on the American Rescue Plan Act of 2021.

UPDATE MAY 12,2021

Please click HERE to open PowerPoint presentation from the NACo National Membership call on Tuesdsay, May 11,2021.

Click HERE to view Treasury interim final rule published on Monday, May 10, 2021

If you do not see your county listed in the portal, please let MAS know by email SGray@massup.org or call MAS office at 601.353.2741. NACo is working with U.S. Treasury on missing counties to have them add to the portal. Some counties are missing nationwide from the portal, not just in MS. Please let us know if you do not see your county and we will let NACo know who will have U.S. Treasury add your county to the portal.

|

TREASURY PORTAL OPEN FOR COUNTIES TO RECEIVE FISCAL RECOVERY FUNDS |

|

|

JOIN TREASURY FOR A BRIEFING ON THE NEW GUIDANCE TODAY AT 4:00 PM Central Time – OR – TOMORROW AT 3:00 PM Central Time |

|

|

On Monday, the U.S. Department of Treasury released guidance on the State and Local Coronavirus Fiscal Recovery Fund (Recovery Fund), part of the American Rescue Plan Act. The bill includes $65.1 billion in direct, flexible aid to every county in America, as well as other crucial investments in local communities. Additionally, the U.S. Treasury opened the new portal that counties must complete to receive Fiscal Recovery Fund If you were unable to join the Treasury briefings on Monday, the agency is hosting two additional briefings today, May 12 at 5 p.m. EDT and tomorrow, May 13 at 4 p.m. EDT. Click HERE to register for call today, Wednesday, May 12,2021 at 4:00 PM Click HERE to register for call tomorrow, Thursday, May 13, 2021 at 3:00 PM

|

UPDATE MAY,11,2021

|

TREASURY OPENS PORTAL FOR COUNTIES |

||||

|

JOIN NACo TODAY AT 1 P.M. CENTRAL TIME FOR Click HERE to register for membership call |

||||

|

||||

|

Join NACo today at 1 p.m. for a national member call to learn more, and stay tuned for an in-depth analysis of Treasury’s new guidance in the coming days. Please note that the call is for NACo members only. |

||||

|

ACCESS THE GUIDANCE | ACCESS THE PORTAL | REGISTER FOR TODAY'S CALL UPDATE MAY 10, 2021 |

|

||

|

JOIN TREASURY FOR A BRIEFING ON THE NEW GUIDANCE TODAY (May 10, 2021) AT 3:00 P.M. CENTRAL TIME OR AT 5:45 P.M. CENTRAL TIME |

||

|

Today, the U.S. Department of Treasury released guidance on the State and Local Coronavirus Fiscal Recovery Fund (Recovery Fund), part of the American Rescue Plan Act. The bill includes $65.1 billion in direct, flexible aid to every county in America, as well as other crucial investments in local communities. Additionally, the U.S. Treasury opened the new portal that counties must complete to receive Fiscal Recovery Funds. Today, the U.S. Treasury and the White House Office of Intergovernmental Affairs will host two identical 30-minute introductory briefings on the new guidance. The briefings will be held today, May 10, at 4:00 p.m. EDT (register here) and 6:45 p.m. EDT (register here). Since the package was signed into law, NACo has been supporting the U.S. Treasury’s efforts to successfully implement the Recovery Fund. Included in the guidance is the flexibility to use Recovery Funds to invest in broadband infrastructure, services and programs to contain and mitigate the spread of COVID-19, including capital investments in public facilities, investments in housing and neighborhoods and other guidance counties advocated for. NACo will release an in-depth analysis of Treasury’s new guidance in the coming days. |

||

|

ACCESS THE GUIDANCE | ACCESS THE PORTAL | VIEW NACo's STATEMENT |

For more information, please open the following link to NACo's websites for more details and estimated allocation for your county from the American Rescue Plan Act of 2021: COVID-19 Recovery Clearinghouse (naco.org)

U.S. Treasury Releases New Guidance on Certification Process for State and Local Fiscal Recovery Fund: Update from NACo on 4.15.2021

The U.S. Treasury released its guidance on pre-award requirements, outlining immediate steps counties need to take to receive direct payments from the U.S. Treasury under the Coronavirus State and Local Fiscal Funds authorized by the American Rescue Plan Act. As soon as possible, county governments should complete the steps below:

1. Ensure the entity has a valid DUNS number. A DUNS number is a unique nine-character number used to identify an organization and is issued by Dun & Bradstreet. The federal government uses the DUNS number to track how federal money is allocated. A DUNS number is required prior to registering with the SAM database, which is outlined below. Registering for a DUNS number is free of charge. If an entity does not have a valid DUNS number, please visit https://fedgov.dnb.com/webform/ or call 1-866-705-5711 to begin the registration process.

2. Ensure the entity has an active SAM registration. SAM is the official government-wide database to register with in order to do business with the U.S. government. All federal financial assistance recipients must register on SAM.gov and renew their SAM registration annually to maintain an active status to be eligible to receive federal financial assistance. There is no charge to register or maintain your entity SAM registration. If an entity does not have an active SAM registration, please visit, SAM.gov to begin the entity registration or renewal process. Please note that SAM registration can take up to three weeks; delay in registering in SAM could impact timely payment of funds. Click here for a quick overview for SAM registration

3. Gather the entity’s payment information, including: Entity Identification Number (EIN), name and contact information Name and title of an authorized representative of the entity Financial institution information (e.g., routing and account number, financial institution name and contact information)

NACo will keep you updated as additional guidance for the Coronavirus State and Local Fiscal Recovery Fund is released in the coming weeks. Visit our new COVID-19 Recovery Clearinghouse for timely resources, including allocation estimations, examples of county programs using federal coronavirus relief funds, the latest updates from the U.S. Department of Treasury and more. National Association of Counties.

Update on 4/1/2021

The MAS office has received multiple calls inquiring about a “form” counties will need to fill out to in order to receive funding from the U.S. Treasury Department as part of the American Rescue Plan Act of 2021. MAS has confirmed with the National Association of Counties (NACo) that the U.S. Treasury Department is developing a form that will be a required component of the application, but that form has not yet been published.

MAS will update our members when the form is made available. It is very important that counties follow the guidelines of the American Rescue Plan Act very closely. MAS staff is monitoring the process and working with NACo and other sources to ensure we have accurate information for our members. MAS will continue to provide updates on this process.

Please watch for more updates in the near future. If you would like to be added to our email/texting distribution list, please email Yamaiky Gamez at YGamez@massup.org